What is Help to Buy – Wales?

Help to Buy – Wales is a government-backed scheme designed to help existing homeowners or first-time buyers buy a new build home with just a 5% deposit.

From April 2023 until September 2026, Help to Buy – Wales is available on new-build houses with an EPC rating of B or higher and a purchase price of no more than £300,000.

How does it Work?

Help to Buy Wales provides an equity loan from the Welsh government.

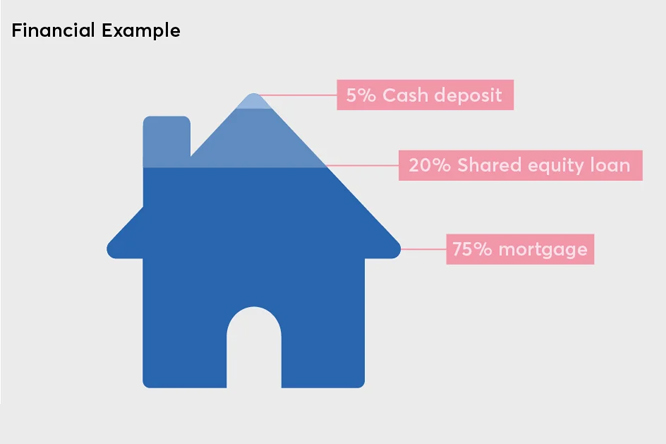

If you’re eligible, you can borrow up to 20% of the property’s market value to top up your deposit and reduce your mortgage costs. And it’s interest-free for the first five years!

You must be able to fund up to 80% of your selected property through a combination of a conventional repayment mortgage and a minimum cash deposit of 5% of the purchase price.

Can I apply?

To benefit from the Help to Buy – Wales scheme, you must:

• purchase an eligible home in Wales with a maximum price of £300,000 from an approved builder

• be able to pay at least 5% of the property’s value

• secure a first-charge mortgage with a qualifying lender to cover the remaining 75%

• not sublet any part of the house you’re buying

• not use the scheme to purchase a second home

• not rent your existing home

Calculate your Stamp Duty

Use our handy calculator to work out how much Stamp Duty you'll pay on your new home.

Mortgage Calculator

Our easy-to-use, free online mortgage calculator is perfect for anyone who is interested to find out how much their monthly mortgage repayments might be.

Help to Buy Wales is available on selected developments and plots only and is subject to eligibility criteria. From 1st April 2023 until September 2026, Help to Buy Wales is only available on homes with a minimum EPC rating B and a maximum purchase price of £300,000. You must be able to fund at least 80% of the property price through a combination of a repayment mortgage and a minimum deposit of 5% of the purchase price. You must take out a first charge repayment mortgage with a qualifying lender. You must not set-let any part of the house you are buying through the scheme and you must not be renting your existing home and buying a 2nd home through the scheme. YOUR HOME MAY BE REPOSSOSED IF YOU DO NOT KEEP UP WITH REPAYMENTS ON YOUR MORTGAGE.